In Australia, the Australian Taxation Office (ATO) performs a vital function in making sure that tax regulations are honored by businesses and other people. On the subject of contingent employees, like freelancers, contractors, and short term team, the two companies and workers should navigate ATO compliance to prevent penalties and lawful difficulties. In the following paragraphs, we'll discover The important thing components of ATO compliance for contingent staff in Australia.

1. Worker or Contractor? The Classification Problem:

The to begin with ATO compliance trouble is the right way classifying workers. The ATO has very clear pointers on the distinction between workers and contractors. Misclassification can provide about authorized and monetary implications. Knowing the variations is very important to find out that's accountable for tax obligations.

two. ABN and TFN: The Crucial Figures:

For ATO compliance, all contingent staff must possess an Australian Small business Number (ABN) in addition to a Tax File Range (TFN). Companies really should ask for and confirm these figures working with their contingent staff. Contingent staff really should deliver their ABN on invoices In combination with their TFN when demanded.

three. The Pay out As You Go (PAYG) Procedure:

Contingent employees often function underneath the PAYG withholding system. In This technique, companies withhold portion from the payment as tax, making certain the ATO gets its share. It is the duty of employers to withhold the right total, dependent for your worker's TFN declaration or withholding declaration.

four. Superannuation Contributions:

Superannuation contributions really are a important part of ATO compliance for contingent staff. Frequently, companies usually are certainly not pressured to help with a contractor's superannuation fund. Having said that, the problem may modify depending across the contractor's classification or maybe the certain conditions Using the deal.

5. Compliance with Truthful Function Rules:

ATO compliance really should align with Reasonable Function Act specifications. Businesses will need to be sure that their contingent personnel get the get more info minimum amount wages and entitlements prescribed Together with the Fair Perform Act, in spite of their classification as contractors.

6. Record-Retaining for ATO Compliance:

Keeping correct information is crucial for ATO compliance. Businesses have to have to help keep detailed data of payments, ABNs, TFNs, and tax withheld. Contingent workers must also retain information of greenbacks, expenses, and tax obligations.

7. Reporting to your ATO:

Companies are needed to report contractor payments around the ATO with the Taxable Payments Once-a-year Report (TPAR). This report details payments to contractors and subcontractors, which includes their ABNs. It truly is submitted per year.

8. Implications of Non-Compliance:

Non-compliance with ATO rules may end up in penalties, fines, and legal implications for each businesses and contingent employees. Right classification, exact file-retaining, and well timed reporting are vital to halt this sort of challenges.

In summary, ATO compliance for contingent workers in Australia could be a advanced but vital element of contingent workforce management. Businesses and personnel has to be nicely-educated concerning the polices encompassing employee classification, tax obligations, superannuation, and good work guidelines. By adhering to ATO recommendations, businesses can make sure that their contingent workforce operates inside the bounds with the legislation, keeping away from expensive penalties and lawful difficulties. To guarantee compliance, It is often really theraputic for corporations to consult with legal and tax experts or use payroll solutions proficient in contingent employee management.

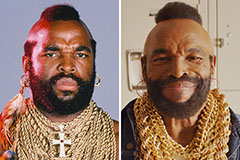

Mr. T Then & Now!

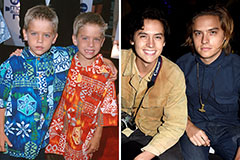

Mr. T Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Jurnee Smollett Then & Now!

Jurnee Smollett Then & Now! Barbi Benton Then & Now!

Barbi Benton Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now!